There are many ways that you can use to earn extra income,

but if you want to be more sustainable financially then it’s important to look for a way that makes sense for you. There is nothing worse than spending lots of time and effort only to find yourself unable to afford the things you need to survive.

That said, there are plenty of ways in which you can start earning an additional income. For example, you can take online surveys, sell products, write reviews, blog about your interests and so much more. In fact, we have put together a list of apps that you may want to consider using. They are all designed to help you get out of debt and achieve financial freedom.

So let’s take a closer look at our top budgeting tools.

Which App Is Best for Budgeting?

Budgeting apps have become very popular over the last few years. If you want to learn more about them, here are a couple of the most useful options available.

You can use Mint to track your spending. You’ll be able to set up budgets, and this will help you keep on top of all of the money that you’re putting away.

Another option is to use YNAB (you need a book). This program helps you manage your finances by tracking where every penny goes. You can even categorize the different expenses so that you know exactly how much you spent in each category.

If you’re looking for an app that lets you earn extra cash, then check out Earnest. With this tool, you’ll get paid to take surveys or complete other tasks.

These are just two of the many budgeting apps available on the market today. There’s no doubt that they’re a great way to save money and stay organized.

How Do You Use the 50 30 20 Budget?

As a parent, you might be worried about how much money you have to spend on your baby. If you’re looking to save as much money as possible, then you need to make sure that you know where all of your funds are coming from. This is why you should try to figure out the best apps that you can use to help you manage your finances.

You can start by using a basic app like Mint.com. You’ll get an overview of everything that you earn and spend. Then, you can download more advanced apps, such as the one that I’ve mentioned below.

There’s no doubt that you want to keep track of your spending. That way, you won’t end up with any surprises later on. The good news is that there are a lot of great budgeting apps out there. Here is the list of my favorite ones.

1. Simple Dollar – With this app, you can easily create budgets and then monitor them throughout the month. It’s very easy to set goals, so it will help you stay focused on saving money.

How Can I Free Up My Budget Money?

Budgeting apps are great tools that help you to keep track of your spending. If you’re looking to save some extra cash, you might want to check out these five best budget apps.

1. Mint.com

2. Personal Capital

3. Quicken

4. YNAB

5. Mvelopes

If you’re interested in learning how to manage your finances better, you should use one of the many budgeting apps available online. The first app you need to try is Mint. This tool helps you to easily monitor all of your financial transactions, so you can make sure that you’re staying within your budget.

Personal Capital is another good option for managing your personal finances. It’s a web-based platform that allows you to set up different budgets and goals. You’ll also be able to see where you stand financially.

Quicken is yet another popular choice for people who are looking to control their finances. It has a lot of features, including the ability to create multiple accounts.

Is Saving 1000 a Month Good?

Many parents have no idea how much money their children spend. However, when you’re a parent, you need to make sure that you save as much money as possible. If you don’t, you could end up spending more than you earn.

One way of doing this is by using budget apps. There are many different kinds of these programs available, so it’s important to choose one that suits your needs . You should also consider whether you want to use an app on a mobile device or computer.

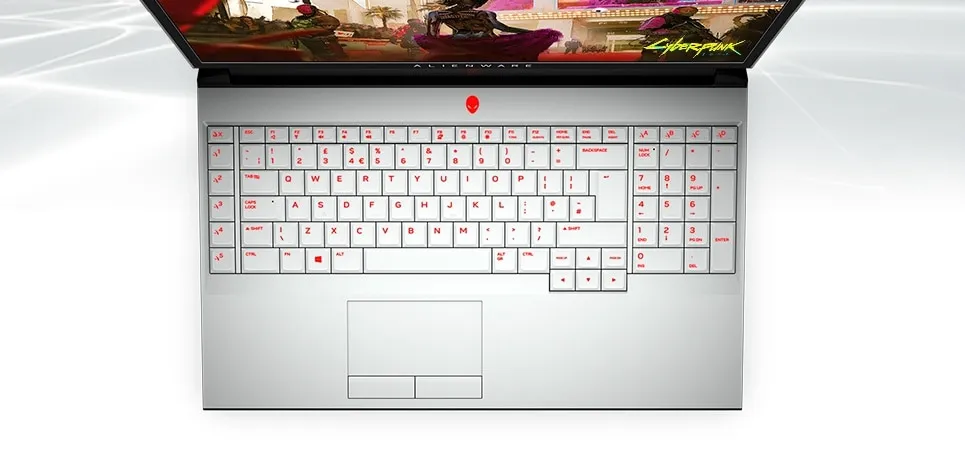

You can get some great advice from the our website alienware area51 threadripper. This is a guide to help you learn about the best ways to manage your finances.

A lot of people assume that they will never be able to afford to buy their child anything. But, there are plenty of things that you can do to ensure that you’ll be able to provide them with everything that they might need.

If you’re having a baby, you’ll probably start earning less money while you’re pregnant. So, you’ll need to look for other ways to raise funds.

How Much Should I Be Spending on Groceries per Month?

If you want to make sure that you’re getting the most value for your money, then you need to know how much you can spend on food. If you don’t have a budget app, then here’s an article that explains why you should use one.

It is important to keep track of where you spend your money. This will help you figure out whether or not you can afford certain purchases.

You can get started by creating a spreadsheet. You can also create a list of all the different expenses in your life. Then, you can start adding up the costs for each item.

In addition to keeping track of your monthly expenditures, it is also helpful to set a goal. For example, you might decide to save $100 every week. After six months, you’ll have saved enough money to buy your first car.

A good way to ensure that you’re saving as much money as possible is to avoid buying anything unless you absolutely need to.

Conclusion:

In conclusion, this might depend on how big your family is. The amount of money you spend depends on several factors such as number and age of kids, how many people live in the household, where you live, and whether you have pets.

So there you have it! My top 20 list of awesome resources for writers. There are tons more out there, so keep searching until you find what works best for you.